25 December, 2025

Smart Financial Habits You Can...

In today’s fast-paced world, managing your money doesn’t have to...

Read more![]()

12 December, 2025

Beware of Loan and Credit...

Financial fraud is on the rise, and loan and credit...

Read more![]()

28 November, 2025

Smart Ways to Maximize Your...

Introduction In today’s fast-paced world, every purchase counts. Whether you’re...

Read more![]()

14 November, 2025

Phishing Campaigns Targeting Social Media...

Attackers are increasingly targeting popular messaging and social apps with...

Read more![]()

28 October, 2025

How Credit Cards Work: Everything...

What Is a Credit Card and How Does It Work?...

Read more![]()

20 October, 2025

Safe Online Shopping: How to...

Online shopping has transformed how we buy — from daily...

Read more![]()

02 October, 2025

Boost Your Credit Score with...

What is the 5/24 Credit Card Strategy and How Does...

Read more![]()

26 September, 2025

AI-Powered Credit Card Fraud: How...

Fraud isn’t just pickpockets or phone scammers anymore. Today, criminals...

Read more![]()

25 September, 2025

What is the 70/20/10 Rule...

Introduction When it comes to managing personal finances, most people...

Read more![]()

22 September, 2025

Outsmarting the Psychology Behind Credit...

When you pay with a credit card, do you notice...

Read more![]()

29 August, 2025

How to Manage Your Credit...

Credit cards can be powerful tools for financial flexibility, offering...

Read more![]()

26 August, 2025

Watch Out: Smishing Scams Are...

Most of us are aware of email scams (phishing). But...

Read more![]()

30 July, 2025

Watch Out: WhatsApp and Telegram...

There has been a sharp increase in investment scams, recently...

Read more![]()

22 July, 2025

Deferring Your Loan Repayment? Here’s...

Life can throw unexpected financial events — job loss, medical...

Read more![]()

26 June, 2025

Improving Financial Health with a...

Credit cards are often seen as a path to debt—but...

Read more![]()

24 June, 2025

Click Smart, Shop Safe: How...

Updated Best Practices to Detect Fake Sites & Protect Your...

Read more![]()

28 May, 2025

Tips for Finding the Best...

Personal loans can be a practical solution for a variety...

Read more![]()

21 May, 2025

Beware of Scams Asking for...

Beware of Scams Asking for Money to Process Loan or...

Read more![]()

22 April, 2025

Know Your Credit Card Fees

Credit cards are a convenient tool for everything, from daily...

Read more![]()

17 April, 2025

Is Your Credit Card Safe...

Online shopping is convenient, fast, and often cheaper—but it’s also...

Read more![]()

25 March, 2025

Difference Between Corporate Deposits and...

When it comes to securing financial stability and maximizing returns,...

Read more![]()

19 March, 2025

Digital Wallet Frauds: How Scammers...

With the rise of cashless transactions, digital wallets have become...

Read more![]()

28 February, 2025

How to Check Your Eligibility...

Personal loans are a popular financial solution in the UAE,...

Read more![]()

25 February, 2025

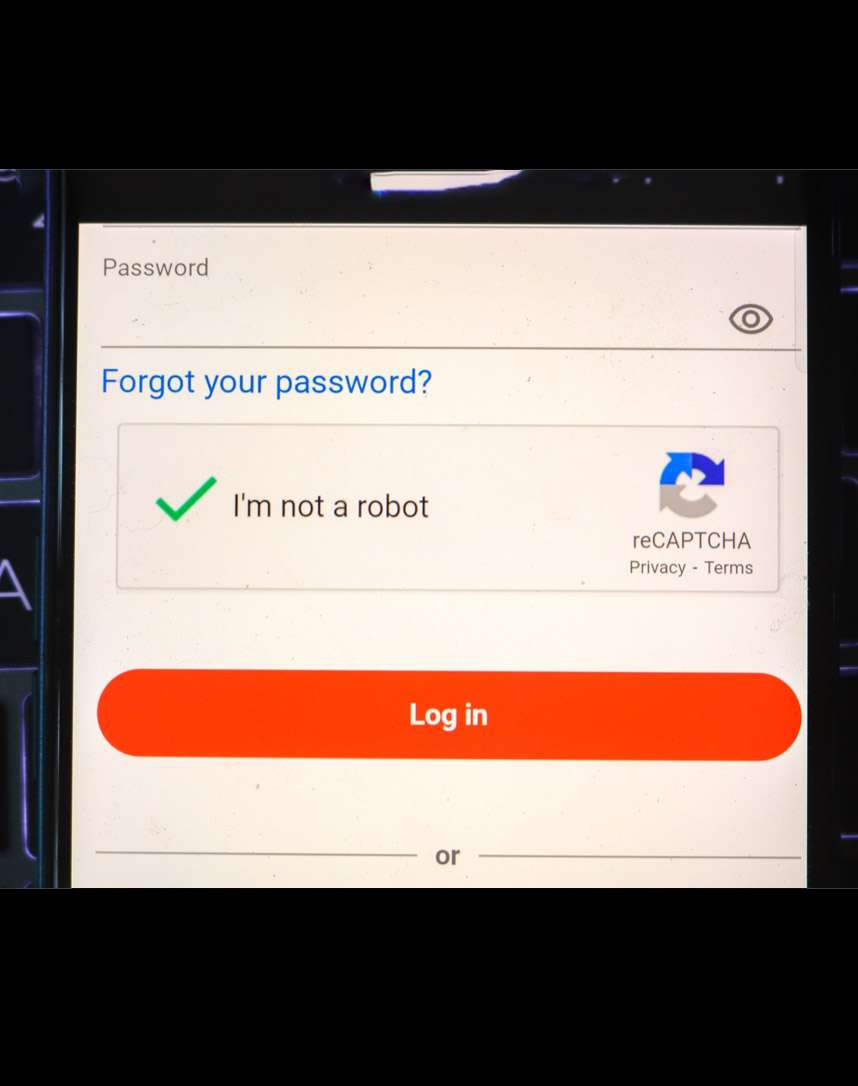

Fake Human Verification: The New...

In the digital world, security measures like CAPTCHA (Completely Automated...

Read more![]()

28 January, 2025

Common Credit Card Mistakes and...

Credit Cards can be incredibly useful tools for managing your...

Read more![]()

16 January, 2025

Staying Safe While Using Peer-to-Peer...

Protecting yourself against fraud is a vital part of managing...

Read more![]()

23 December, 2024

Understanding Credit Cards: Maximize Rewards,...

Credit cards provide convenience, security, and access to exciting rewards....

Read more![]()

20 November, 2024

First-Time Credit Card Users: Build...

Getting your first credit card is an exciting step, offering...

Read more![]()

12 November, 2024

Beware of AI-Enhanced Investment Scams

As technology evolves, so do the tactics used by scammers....

Read more![]()

25 October, 2024

Credit Card Dos and Don’ts:...

Credit cards can be a fantastic financial tool when used...

Read more![]()

18 October, 2024

Protect Yourself from SIM Swap...

In today’s digital landscape, safeguarding your personal and financial information...

Read more![]()

24 September, 2024

The Risks of Sharing Personal...

Social media has become integral to modern life, providing a...

Read more![]()

10 September, 2024

Investment Basics: Stocks, Bonds, Mutual...

Investing is a powerful strategy to build wealth and achieve...

Read more![]()

26 August, 2024

Beware of Look-alike Websites

Convenience and speed have made doing things online the go-to...

Read more![]()

20 August, 2024

Mastering Financial Goal Setting and...

Achieving financial stability starts with setting clear and attainable financial...

Read more![]()

23 July, 2024

Beware of False Promotional Offers

In today's world where information is readily accessible and transactions...

Read more![]()

11 July, 2024

Automating Your Credit Card and...

Managing finances efficiently is essential, making automating your credit card...

Read more![]()

05 July, 2024

Dont Fall for Fake Messages:...

Scammers are becoming increasingly sophisticated in their tactics, and it's...

Read more![]()

05 July, 2024

Boost Your Credit Score: A...

Your credit score is a critical component of your financial...

Read more![]()

19 June, 2024

Invest in Your Financial Education:...

In today's fast-paced world, financial stability and independence are more...

Read more![]()

05 June, 2024

Beware of High-Discount Scams: Protecting...

In today's digital age, online shopping has become a convenient...

Read more![]()

25 April, 2024

Emergency Saving: Your Safety Net...

Emergencies can happen to anyone, at any time. While we...

Read more![]()

18 April, 2024

Beware of Credit Card Application...

Credit card application fee scam target individuals seeking access to...

Read more![]()

20 March, 2024

Fast-Track Your Saving Success with...

Saving money is a crucial aspect of your financial well-being,...

Read more![]()

12 October, 2023

Enhancing Your Online Security with...

In an increasingly digital world, protecting our online presence has...

Read more![]()

27 September, 2023

The 50-30-20 Rule: A Blueprint...

Managing your finances effectively is crucial for achieving financial stability...

Read more![]()

20 September, 2023

Maximizing Savings: A Comprehensive Guide...

Credit cards have become an essential financial tool for many,...

Read more![]()

31 August, 2023

Protecting yourself against online scams

In today's digital age, the convenience of online banking, online...

Read more![]()

23 August, 2023

Achieving Financial Security: Your Path...

In a world marked by uncertainty, achieving financial security has...

Read more![]()

11 August, 2023

The Benefits of an Easy...

There are many goals and aspirations we want to achieve...

Read more![]()

03 August, 2023

Understanding Merchant Loans: A Powerful...

In today's fast-paced business world, securing funding is often a...

Read more![]()

27 July, 2023

Protecting Your Finances: The Importance...

In today’s world, everyone prefers to manage their funds digitally...

Read more![]()

20 July, 2023

Achieve Your Dreams with Personal...

Personal Loans can help you achieve your dreams, whether you...

Read more![]()

07 July, 2023

Maintaining a Good Credit Score

A good credit score is essential for financial stability and...

Read more![]()

22 June, 2023

Budgeting helps control your finances

Having control over your finances ensures you don't fall a...

Read more![]()

14 June, 2023

Make the most of Eid...

Eid Al Adha is one of the most important festivals...

Read more![]()

13 June, 2023

Important Phishing Alert

We want to bring an important matter to your attention...

Read more![]()

24 May, 2023

Achieve Financial Peace of Mind...

Credit cards have become an essential financial tool for many...

Read more![]()

16 March, 2023

Financial Stability with Deem: 5...

We have endless ways to splurge on our daily necessities,...

Read more![]()

09 December, 2019

Want to get a Loan?...

Getting a personal loan to buy property, pay for your...

Read more![]()

© All rights reserved 2026 Deem Finance LLC. Deem Finance LLC (Deem) is regulated by Central Bank of the UAE.